Due to the inclusion of promotional expenses and bonuses in its sports betting law, Virginia is missing out on a significant amount of potential revenue. The Richmond Times-Dispatch reports that the state has forfeited 43.7% of its taxable revenue from sports betting as a result.

Virginia pays a hefty price for lax sports betting law

The existence of promotional offers and bonuses (commonly in the form of free bets) in states where sports betting is legal has resulted in significant discrepancies in tax revenue.

In the state of New York, sports betting was officially legalized in January. The total gross gaming revenue (GGR) for the initial two months surpassed $138 million, resulting in taxable revenue of over $70 million after applying a tax rate of 51%. This revenue encompasses earnings from bonuses and promotions as well.

In comparison, Virginia’s betting industry, which is relatively smaller, has generated $390 million in Gross Gaming Revenue (GGR) since its introduction in 2021. However, it has also permitted $168.8 million worth of bonuses and promotional offers. Under Virginia law, bettors are allowed to deduct these promotional incentives, resulting in a taxable revenue of $26.7 million for the state.

Out of the 30 states where sports betting is legal, only eight states permit sports betting companies to subtract promos and bonuses. These states include:

- Arizona

- Colorado

- Connecticut

- Louisiana

- Michigan

- Pennsylvania

- Virginia

- Wyoming

Earmarking sports betting tax revenue

Originally established to support the growth of the sports betting industry, these deductions have indeed fulfilled their purpose. However, the state has been slow to collect its due. The Virginia Lottery, responsible for overseeing sports betting in the state, recently discovered that out of the 12 operators, only five have fulfilled their tax obligations.

Why? It’s because operators can take advantage of significant deductions that they can write off. Virginia has to bear the burden of this high cost due to its lenient sports betting law.

Many states have designated tax revenue from sports betting for various initiatives, but the effectiveness of these initiatives is being greatly affected by the deductions allowed on promotional offers.

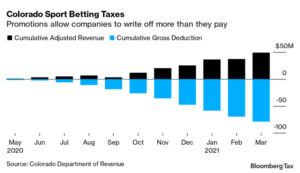

Colorado’s sports betting tax revenue is allocated towards addressing the state’s persistent water shortage crisis. Unfortunately, the taxable revenue from sports betting in Colorado fell significantly below initial projections, only reaching about half of the expected amount in the first year.

What is the reason behind tax exemptions for promotional offers?

Companies take advantage of lax sports betting laws

The impact of allowing companies to deduct unlimited free play and promotional bets from the GGR ultimately leads to negative consequences for the state, as highlighted by Ulrik Bolsen at the Tax Foundation.

If there is no limit to the number of promotional deductions that can be taken, the imposition can no longer be considered an excise tax. In such a scenario, any operator could effectively eliminate their tax liability by simply offering unlimited promotions.

Despite Del. Mark Sickles’ efforts with HB 1103, his proposed bill failed to advance beyond the General Laws Committee. The objective of his legislation was to establish a restriction on the duration for which companies could deduct promotions. More specifically, Sickles’ bill aimed to provide sports betting companies with a one-year deduction period.

Virginia’s lenient sports betting law comes at a high cost to the state due to the allowance of unlimited deductions.

The issue will have to be reconsidered by Virginians in the upcoming legislative session. The urgency to pass a bill similar to Sickles’s and the state’s loss of tax revenue will both increase.